long island tax rate

The 2018 United States Supreme Court decision in South Dakota v. How to Challenge Your Assessment.

New York Paycheck Calculator Smartasset

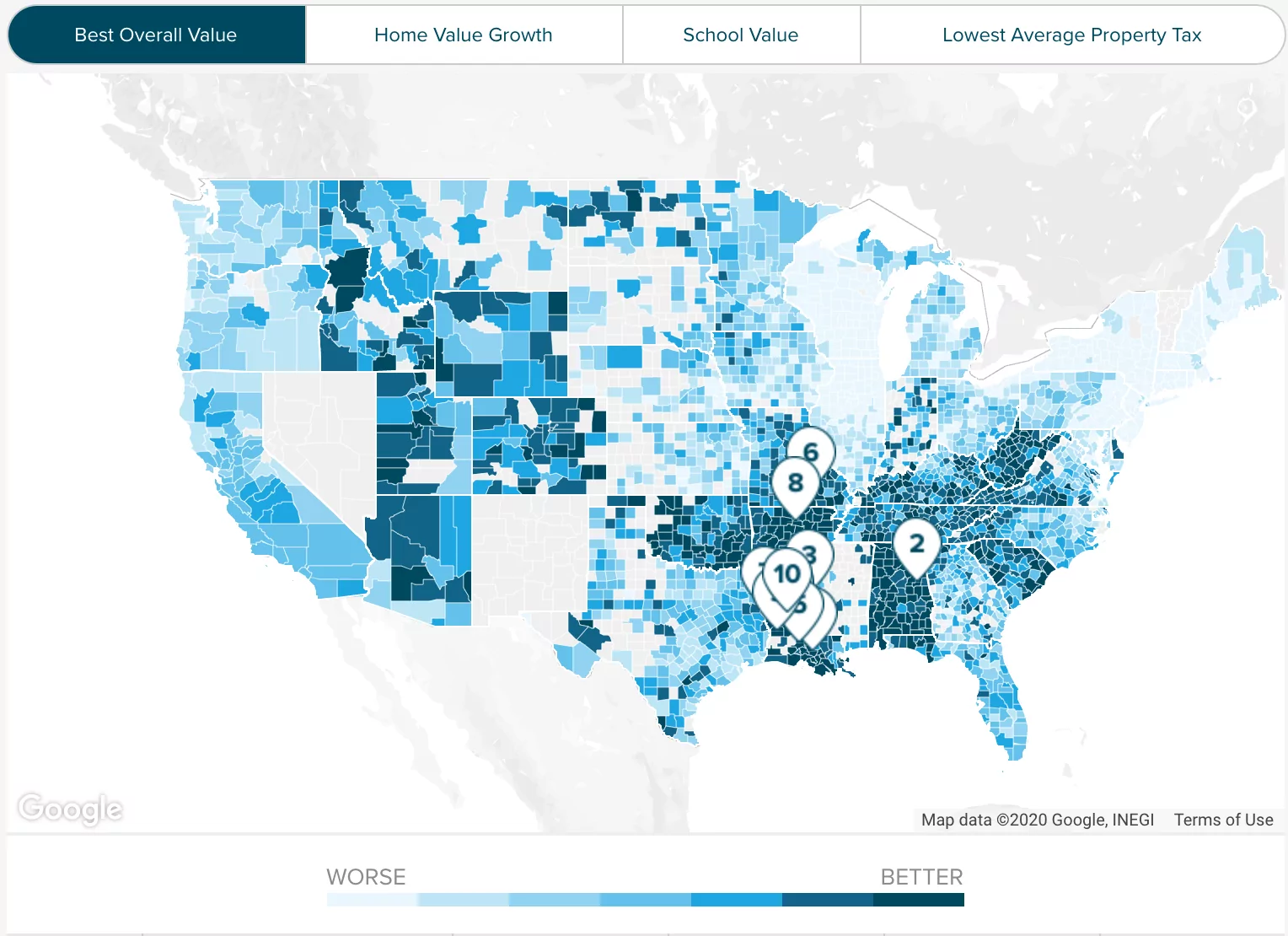

Check out some of the states with low property tax rates.

. The minimum combined 2022 sales tax rate for Nassau County New York is 863. Rules of Procedure PDF Information for Property Owners. The December 2020 total local sales tax rate was also 7000.

Has impacted many state nexus laws and sales tax collection. Its no secret that Long Island property taxes are high. The New York state sales tax rate is currently 4.

The County sales tax rate is. Long Island is in the following zip codes. The Long Island City sales tax rate is.

In 2018 the average millage rate in the county was 264 mills which would mean annual taxes of 7920 on a 300000 home. The average effective tax rate is approximately 211 which means taxes on that same home are likely closer to 6330 annually. The December 2020 total local sales tax rate was also 8875.

Long Island school districts 2016-17 tax plans I grew up in. ZIP code 11003. The current total local sales tax rate in Long Island City NY is 8875.

Mortgages 1000000 or less for 1 2 Family Dwellings. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7 The Sales tax rates may differ depending on the type of purchase. To learn more call 631-761-6755.

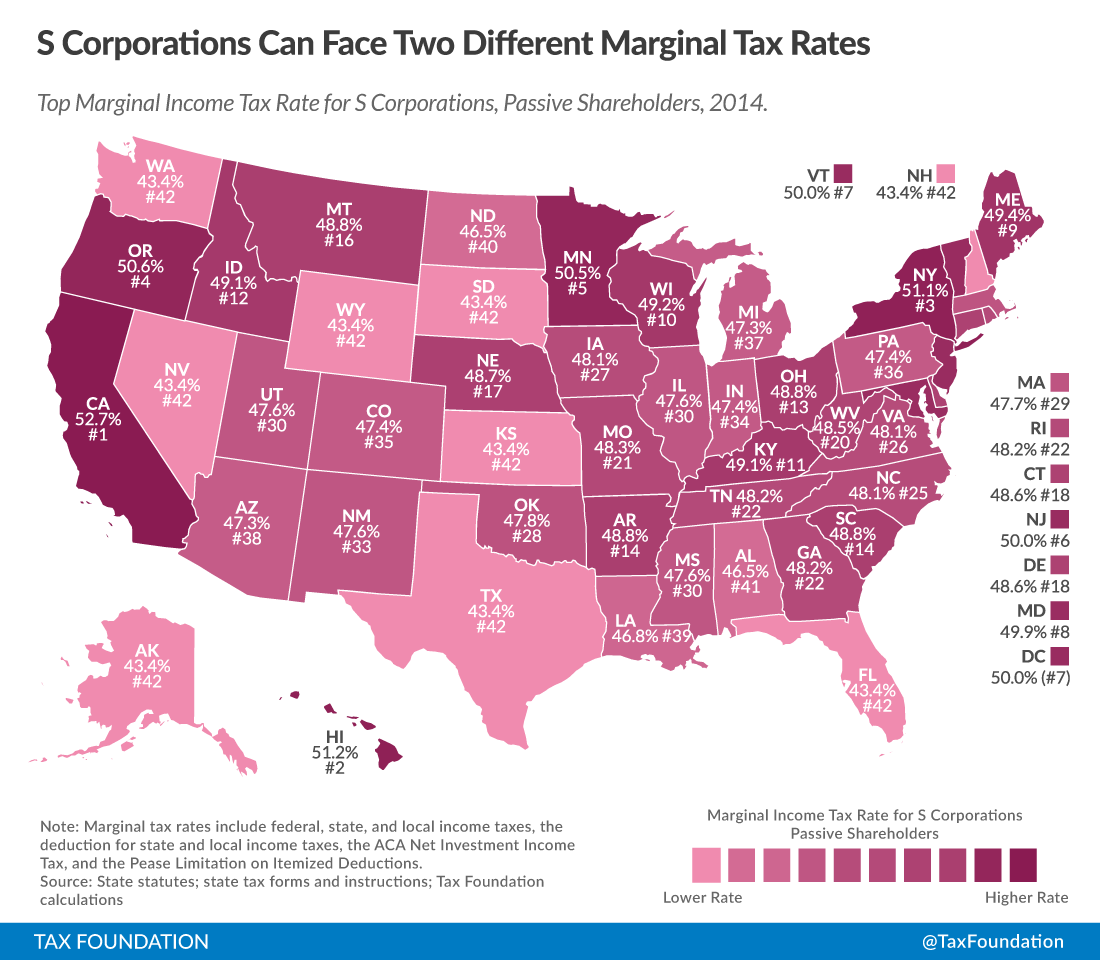

Assessment Challenge Forms Instructions. What is 1200 after taxes. The top marginal tax rate is now 396 percent.

Sales Tax Breakdown Long Island Details Long Island KS is in Phillips County. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875. Sales Tax Breakdown Long Island City Details Long Island City NY is in Queens County.

According to the tax year 2022 estimate 1200 after tax equals 1200 NET compensation annually. Average SALT deductions 1758097. The New York sales tax rate is currently.

There are a total of 988 local tax jurisdictions across the state collecting an average local tax of 4229. Long Island City is in the following zip codes. To learn more call 631-761-6755.

Lower Property Taxes In Suffolk and Nassau New York Call Heller Tax Grievance for a Free tax grievance application. Long Island is on the expensive side but various other options are available. I would refer to Newsday major metro NYC newspaper founded on Long Island for their average Nassau County tax rate chart for 2016.

In order to be taxed at the marginal rate of 396 percent you must earn more than 415000 in taxable income before the first dollar of your income is taxed at that rate. Taxing JurisdictionRateNew York state sales tax400Long Island City tax450Special. Average Sales Tax With Local.

Answer 1 of 2. Comparatively Long Islands average annual property tax amount in 2016 was. The Town of Long Island collects property taxes twice a year on September 15th and March 15th.

Among the many different counties of New York Suffolk and Nassau counties on Long Island have some of the highest property tax rates both over 2. 11101 11109 11120. However effective tax rates in the county are actually somewhat lower than that.

The current total local sales tax rate in Long Island KS is 7000. 4 rows Long Island City NY Sales Tax Rate. For all Counties for which the Mortgage Tax is 10 or more then the borrower is entitled to a 30 Exemption.

Total SALT deductions In thousands 126583. For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm. Arizona063 Delaware062 Utah056 Nevada058 Colorado052 Alabama048 Tennessee061 Keep Your Money in Your Pocket and Save Time.

The Nassau County sales tax rate is 425. Currently the sales tax rate in Long Island City is 8875 percent. Usually it includes rentals lodging consumer purchases sales etc For more information please have a look at Alaskas Official Site More About Long Island Coordinates.

This is the total of state and county sales tax rates. Live on Long Island. High Taxes in Long Island New York reduce property taxes.

The minimum combined 2022 sales tax rate for Long Island City New York is. The minimum combined 2022 sales tax rate for Nassau County New York is 863. There is no applicable county tax.

This is the total of state county and city sales tax rates. Returns with SALT deductions 7200. The New York state sales tax rate is currently 4.

Finally a firm that gives you the individual attention that you deserve. The applicable Mortgage Tax Rate is reduced by 03 with NO 30 deduction. Long Island Tax Accounting Advisory Services Inc.

Long Island City collects the maximum legal local sales tax The 8875 sales tax rate in Long Island City consists of 4 New York state sales tax 45 Long Island City tax and 0375 Special tax. You would pay capital gains on that 300000 increase in property value at a 20 tax rate. 2021 Tax Rates - Single Taxpayers - Standard Deduction 12550.

The sales tax jurisdiction name is New York City which may refer to a local government division. Also Nassau Suffolk counties. Nassau County Tax Lien Sale.

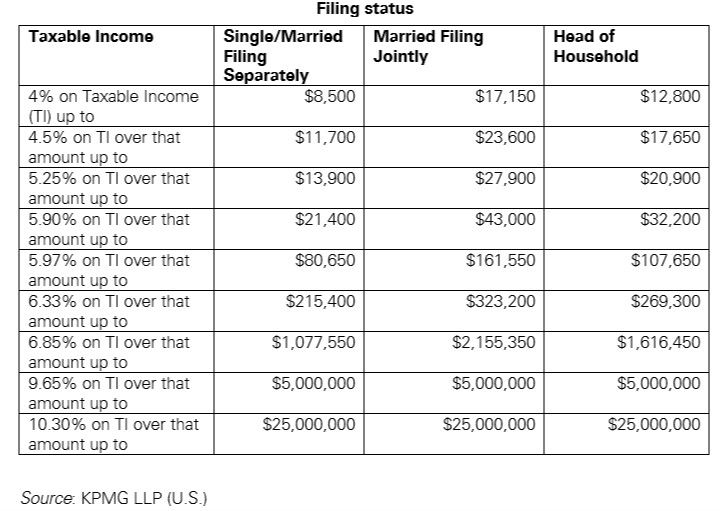

Our clients can always contact us at our Roslyn Long Island office for help with any questions about the best filing status and tax rates. 9 Things You Should Know About The New Tax Plan Biden tax plan and real estate. But under Bidens tax plan individual long-term gains would increase from a 20 rate to a maximum rate of 396 on ordinary income.

157 rows Average real estate tax 1062715.

New York Property Tax Calculator Smartasset

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Property Taxes In Nassau County Suffolk County

States With Highest And Lowest Sales Tax Rates

Property Taxes In Nassau County Suffolk County

What To Know Before Moving To Long Island

What Is The Llc Tax Rate In New York Gouchev Law

Why Households Need 300 000 To Live A Middle Class Lifestyle

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

The Dual Tax Burden Of S Corporations Tax Foundation

How To Calculate Capital Gains Tax H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation

Alameda County Ca Property Tax Calculator Smartasset

Why Households Need 300 000 To Live A Middle Class Lifestyle

County Surcharge On General Excise And Use Tax Department Of Taxation

Us New York Implements New Tax Rates Kpmg Global